Historic Indo-US Trade Deal

On February 7, 2026, India and the United States announced a landmark ‘Interim Trade Agreement’ (ITA), marking a significant structural realignment in their economic partnership. The deal, which follows a year of negotiations launched in early 2025, aims to de-escalate trade frictions and integrate Indian manufacturing more deeply into the U.S. supply chain.

The Agreement marks a major milestone in India’s global trade engagement, securing sustained preferential access for Indian exports in the U.S. market valued at over $30 trillion. The agreement delivers comprehensive tariff rationalisation, zero-duty access across large product categories, enhanced digital and technology cooperation, and a carefully calibrated framework to safeguard India’s farmers, MSMEs and domestic industry.

With India’s total exports to the United States standing at USD 86.35 billion in 2024, the agreement significantly enhances competitive access across key sectors including textiles, leather, gems and jewellery, agriculture, machinery, home décor, pharmaceuticals, and technology-driven industries.

Key Components of the Deal

• Massive Tariff Reductions: The U.S. has reduced effective tariffs on many Indian goods to 18%, down from a peak of nearly 50%. This includes the removal of a 25% punitive duty previously imposed due to India’s purchase of Russian oil.

• Zero-Duty Access: India has secured zero-duty access for exports worth over $38 billion in sectors such as generic pharmaceuticals, processed diamonds, silk, and aircraft parts.

• $500 Billion Purchase Commitment: India intends to purchase $500 billion worth of U.S. energy products, aircraft, technology (including GPUs for data centres), and coking coal over the next five years.

• Strategic Energy Pivot: In a major diplomatic concession, India has agreed to significantly reduce or halt the purchase of Russian crude oil, shifting procurement toward the U.S. and potentially Venezuela

Structural Competitive Advantage Across Key Sectors

The agreement creates a clear tariff differential in favour of India. While duties on Indian products have been lowered, several competing suppliers continue to face elevated tariffs in the U.S. market, including China (35%), Vietnam (20%), Bangladesh (20%), Malaysia (19%), Indonesia (19%), Philippines (19%), Cambodia (19%) and Thailand (19%).

This tariff differential significantly enhances India’s price competitiveness, strengthens its relative positioning in the U.S. market and expands export opportunities across labour-intensive industries, manufacturing segments and high-value product categories.

Sectoral Gains

Textiles & Apparels

Tariffs on textile exports have been reduced from 50% to 18%, while silk receives 0% duty access, opening enhanced opportunities in the U.S. market valued at USD 113 billion.

Major export categories benefiting from the reduced tariff structure include readymade garments, carpets, man-made textiles, cotton textiles, artificial staple fibres, bedspreads, bleached fabrics, curtains, yarn, baby clothing, bed linen, blankets, gloves and related products.

The agreement is expected to provide a significant boost to the textile sector, leveraging economies of scale and strengthening small businesses and production clusters. Enhanced market access is likely to support job creation and reinforce India’s position as a competitive and reliable supplier in global textile value chains.

Leather & Footwear

The agreement delivers significant gains for India’s leather and footwear sector, positioning the country as most-preferred supplier to the U.S. market. Tariffs on exports from India have been reduced from 50% to 18%, providing improved access to a U.S. market valued at USD 42 billion.

Major export categories expected to benefit include finished leather, leather footwear and footwear components. The reduced tariff structure enhances India’s ability to expand its presence across value-added segments of the leather industry.

Given the labour-intensive nature of the leather and footwear industry, enhanced market access is expected to support manufacturing growth and employment generation, particularly across MSMEs and production clusters.

Gems & Jewellery

Tariffs on gems and jewellery exports have been reduced from 50% to 18%, providing preferential access to a U.S. market valued at USD 61 billion.

In addition, 0% duty market access has been secured for major product categories including diamonds, platinum and coins, covering a U.S. market of USD 29 billion. Key export categories expected to benefit include cut and polished diamonds, lab-grown synthetic diamonds, coloured gemstones, synthetic stones and articles of gold, silver, platinum and other precious metals.

Home Décor

Tariffs on home décor exports have been reduced from 50% to 18%, opening opportunities in a U.S. market valued at USD 52 billion. Products benefiting from the reduced tariff structure include wood and furniture items, pillows, cushions, quilts, comforters, non-electrical lamps and related furnishing products.

In addition, 0% duty access has been secured for products covering a U.S. market worth USD 13 billion, including seats, chandeliers, illuminated signs and parts of lamps.

Toys

Tariffs on toy exports from India have been reduced from 50% to 18%, providing improved access to a U.S. market valued at USD 18 billion. With improved market access and a more favourable tariff regime, India is well placed to emerge as a reliable and trusted supplier in the U.S. toy market. The agreement opens new opportunities for domestic manufacturers, particularly MSMEs, to scale production, integrate into global supply chains and expand their presence in international markets.

Machinery and Parts (Excluding Aircraft Parts)

The agreement provides a significant boost to India’s machinery and parts sector by improving access to one of the largest industrial markets in the world. Tariffs on machinery exports have been reduced from 50% to 18%, opening enhanced opportunities in the U.S. machinery market valued at USD 477 billion.

India’s current exports in this segment stand at USD 2.35 billion, and the reduced tariff structure is expected to strengthen the competitiveness of Indian manufacturers across a wide range of machinery and component categories. The improved access supports India’s broader manufacturing ambitions and reinforces efforts to expand value-added industrial exports.

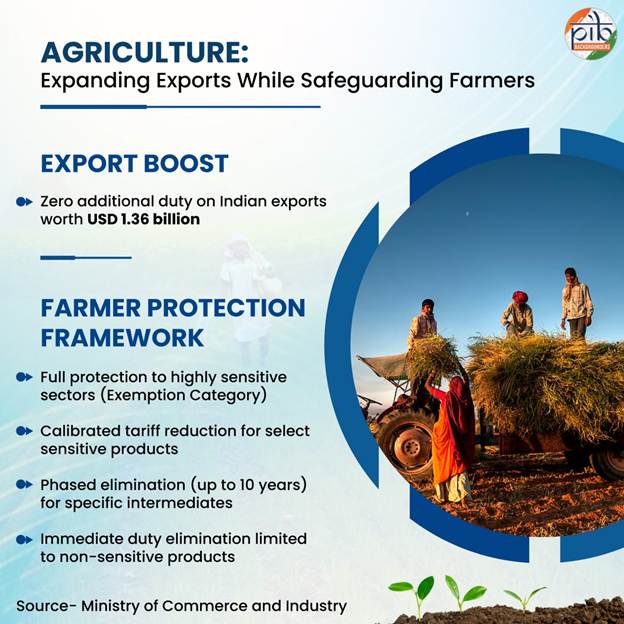

Agriculture: Expanding Export Opportunities While Safeguarding Farmers

India maintains a trade surplus of USD 1.3 billion in agricultural trade with the United States, with exports of USD 3.4 billion and imports of USD 2.1 billion in 2024.

Zero Duty Access for Agricultural Exports

The United States will apply zero additional duty on Indian exports worth USD 1.36 billion. Beneficiary products include spices; tea and coffee and their extracts; copra and coconut oil; vegetable wax; nuts such as areca nuts, Brazil nuts, cashew nuts and chestnuts; fruits and vegetables including avocados, bananas, guavas, mangoes, kiwis, papayas, pineapples shitake, and mushroom; cereals such as barley and canary seeds; bakery products; cocoa, and cocoa preparations; sesame and poppy seeds; and processed products such as fruit pulp, juices and jams.

Within this agricultural products valued at USD 1.035 billion have been assured zero Reciprocal Tariff to avoid uncertainty, providing stability and predictability to Indian farmers and exporters.

Calibrated Market Opening with Strong Safeguards

In line with India’s approach in previous trade agreements, agricultural market access has been structured based on product sensitivity. The offer is categorized into immediate duty elimination, phased elimination (up to 10 years), tariff reduction, margin of preference and tariff rate quota mechanisms.

Highly sensitive agricultural sectors remain fully protected under a carefully crafted Exemption category. These broadly include meat, poultry and dairy products; GM food products; soyameal; maize; cereals; millets such as jawar, bajra, ragi, kodo and amaranth; fruits including bananas, strawberries, cherries and citrus fruits; pulses such as green peas, kabuli chana and moong; oilseeds; certain animal feed products; groundnuts; honey; malt and its extracts; non-alcoholic beverages; flour and meals; starch; essential oils; ethanol for fuel; and tobacco.

For select sensitive agricultural products, the tariff reduction category has been applied to ensure that a measured level of duty protection continues. Examples include parts of plants, olives, pyrethrum and oil cakes. Alcoholic beverages have been offered under tariff reduction along with minimum import price-based formulations, consistent with India’s approach in other FTAs.

Certain highly sensitive items have been liberalised under Tariff Rate Quotas (TRQs), where limited quantities are allowed at reduced duties. Products under this category include in-shell almonds, walnuts, pistachios, lentils etc.

Phased elimination of tariffs over up to ten years has been adopted for certain intermediate products used by India’s food processing industry and sourced from multiple countries. These include albumins; certain oils such as coconut oil, castor oil and cotton seed oil; hoofmeal; lard; stearin; modified starches; peptones and their derivatives; and plants and parts of plants etc. This extended timeline provides adequate adjustment space for domestic stakeholders.

Immediate duty elimination has been offered only for select non-sensitive products that are already liberalised under other FTAs.

Zero-Duty Access for USD 38 Billion in Industrial Exports

The agreement secures zero additional duty access for industrial exports valued at USD 38 billion.

Under Section 232 provisions, zero additional duty will apply to aircraft parts, machinery and machinery parts, generic drugs and pharmaceutical ingredients, and elementary auto parts.

In addition, zero-duty access extends to major industrial product categories including gems and diamonds, platinum and coins, clocks and watches, essential oils, select home décor items such as chandeliers and illuminated signs, inorganic chemicals including iron and aluminium oxides and inorganic compounds of precious metals, instruments and apparatus, minerals and natural resources, articles of paper, plastics and wood, and natural rubber.

Non-Agriculture Market Opening with Robust Safeguards

The agreement reflects extensive stakeholder consultations with industry bodies, sectoral associations and concerned ministries to identify product sensitivities and sector-specific requirements before finalizing the market access framework.

Market access for industrial goods has been structured strictly on the basis of product sensitivity, combining immediate tariff elimination, phased reduction (up to ten years) and quota-based access.

Sensitive sectors such as Automobiles have been liberalised through a combination of quota and duty reduction mechanisms. Medical devices have been addressed through long and staggered phasing schedules. Precious metals and other sensitive industrial products have been managed through quota-based tariff lowering. These calibrated safeguards ensure that liberalisation strengthens competitiveness without compromising manufacturing capacity or employment.

Health and Medical Infrastructure

India and the U.S. demonstrate strong complementarity in the medical devices sector. Improved access to high-end diagnostic and surgical equipment will support the scaling of advanced healthcare infrastructure.

Streamlined entry of life-saving technologies enhances affordability and accessibility of specialised healthcare services, contributing to improved patient outcomes and strengthening India’s medical ecosystem.

India–U.S. Digital Trade Partnership

Digital trade has emerged as one of the fastest-growing components of global commerce. According to WTO data, global digitally delivered services exports rose from USD 4.35 trillion in 2023 to USD 4.78 trillion in 2024, reflecting year-on-year growth of 9.8 percent.

India has consolidated its position as a leading digital exporter. In 2024, India’s digitally delivered services exports stood at USD 0.28 trillion, growing at 10.3 percent year-on-year. India ranks 5th in exports of global digitally delivered services and 11th in the imports. While the United States holds the 1st rank in both exports and imports.

India and the United States possess complementary strengths in digital trade. The United States is the world’s largest importer of digitally delivered services, while India is among the world’s top exporters, with deep capabilities in IT services, business process management and digital solutions.

A structured digital trade framework between the two countries reduces regulatory uncertainty, lowers compliance friction and facilitates smoother cross-border service delivery. This can accelerate growth in digitally delivered services and expand market access for Indian firms.

High Technology and Advanced Technology Imports

The agreement supports India’s technological advancement by facilitating access to high-technology and strategic goods that catalyse domestic capability building. The access to advanced technologies accelerates India’s digital and industrial transformation while reinforcing self-reliance objectives.

Key high-technology categories include advanced medical devices such as diagnostic imaging equipment and surgical robotics; AI chips and high-performance processors; semiconductor manufacturing equipment; cloud computing infrastructure hardware; telecom and ICT network equipment; cybersecurity hardware; non-sensitive aerospace electronics; clean energy technologies including smart grids and meters; precision agriculture technology; biotechnology research equipment; quantum computing components; advanced laboratory and testing equipment; satellite and space technology components; and data centre infrastructure equipment.

To conclude, the India–U.S. Bilateral Trade Agreement represents a transformative step in strengthening economic ties between two major global economies.

By unlocking access to a USD 30-trillion market, rationalizing tariffs across a substantial share of exports, securing zero-duty benefits on large product volumes and reinforcing digital and strategic technology cooperation, the agreement significantly enhances India’s global trade positioning.