Becoming An Economic Power

India became the 4th largest global economy in 2025, driven by domestic reforms and global positioning under the vision of Aatmanirbhar Bharat

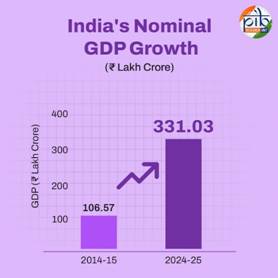

India is the world’s fastest-growing major economy, with real GDP growing at 6.5% and nominal GDP tripling from ₹106.57 lakh crore (2014–15) to ₹331.03 lakh crore (2024–25).

India is projected to be world’s fastest growing major economy (6.3% to 6.8% in 2025-26).

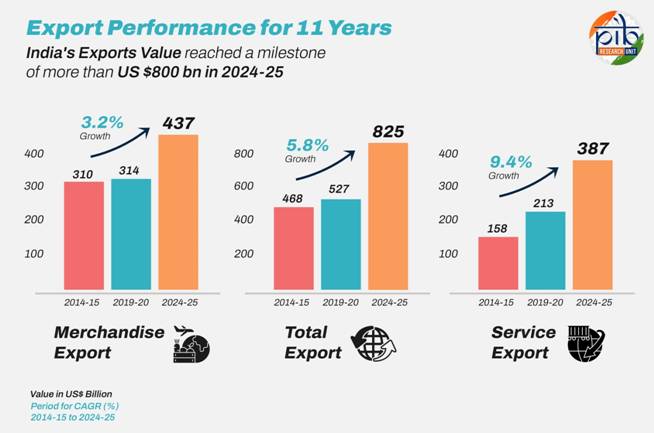

Total exports increased by 76% over the last decade, reaching US$ 825 billion in 2024–25, led by engineering goods, electronics, and pharmaceuticals.

Services exports more than doubled, growing from US$ 158 billion in 2013–14 to US$ 387 billion in 2024–25.

Cumulative FDI inflows reached US$ 1.05 trillion, with a record 27% increase in equity inflows in the first 9 months of FY25 alone.

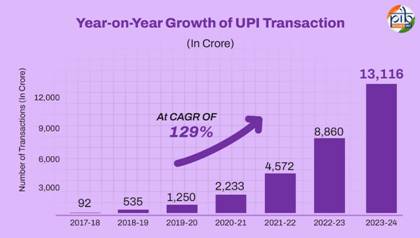

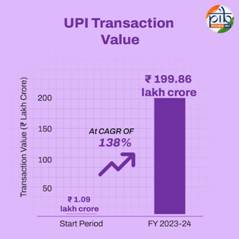

Digital transactions surged 9x in volume (FY18–FY24), with UPI processing 172 billion transactions in 2024 alone.

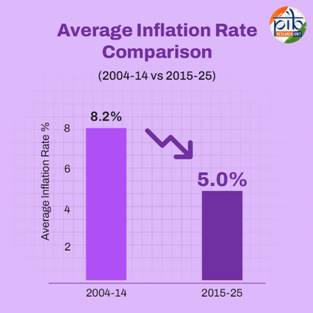

Inflation was reduced from an average of 8.2% (2004–14) to around 5% (2015–25) through targeted fiscal and monetary policies.

Retail inflation fell to 4.6% in 2024–25, the lowest since 2018–19.

The above are the main points that have been highlighted in a government report that was released on June 16 as a part of a series reflecting the progress that the country has made in the past 11 years under the leadership of Prime Minister Narendra Modi.

According to the report, India, the world’s fourth-largest economy, has emerged as the fastest-growing major economy and is on track to become the world’s third-largest economy with a projected GDP of $7.3 trillion by 2030. India is projected to be world’s fastest growing major economy (6.3% to 6.8% in 2025-26).

Driven by robust domestic demand, a dynamic demographic profile, and sustained economic reforms, India is asserting its rising influence in global trade, investment, and innovation.

At the Kautilya Economic Conclave, renowned economist Jagdish Bhagwati remarked: “In the old days, the World Bank used to tell India what to do, but now, India tells the World Bank what to do.” This statement powerfully reflects India’s shift in last Eleven years, from a dependent economy to a self-reliant, globally competitive powerhouse.

At the core of this transformation is the vision of Aatmanirbhar Bharat, a movement that promotes innovation, entrepreneurship, and technological sovereignty.

Under Modi’s leadership, strategic initiatives like the Production Linked Incentive (PLI) schemes, revitalisation of MSMEs, and the expansion of digital infrastructure have laid the foundation for a high-growth, high-opportunity economy.

Equally central to this vision is inclusive and equitable growth. The government’s policies have focused on job creation, support for small businesses, increased public investment, and financial empowerment of the middle class and entrepreneurs, ensuring that economic progress benefits every citizen.

Today, India is a nation that is digital, green, aspirational, and future-ready, firmly advancing towards its goal of becoming a global leader.

GDP Growth: Strengthening the Economic Foundation

India’s GDP has witnessed a remarkable transformation over the past decade. At current prices, GDP has increased from ₹106.57 lakh crore in 2014–15 to an estimated ₹331.03 lakh crore in 2024–25, an approximate threefold rise in just ten years.

In 2024–25 alone, nominal GDP grew by 9.9% over the previous year, while real GDP (at constant prices) increased by 6.5%, reflecting sustained economic momentum. This steep growth reflects the country’s expanding economic base and rising income levels.

During the same period Real GVA (Gross Value Added) rose by 6.4%, and nominal GVA by 9.5%. Private Final Consumption Expenditure (PFCE) grew by 7.3%, driven by a recovery in rural demand, reaching its highest share of GDP (61.8%) since 2002–03.

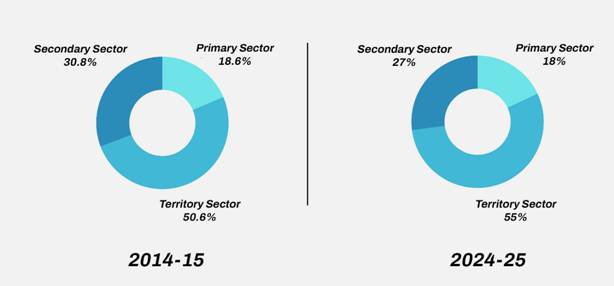

The services sector has remained the steadiest contributor to GVA, with its share rising from 50.6% in FY14 to around 55% in FY25. It also provides employment to approximately 30% of the workforce. In addition to its direct contribution, services play an increasingly vital role in “servicification” of manufacturing, enhancing value through services used in both production and post-production stages.

This sustained momentum is the result of a structural transformation led by the Government, prioritising transparency, ease of doing business, and long-term investments across manufacturing, MSMEs, digital services, and infrastructure.

External Trade: Expanding India’s Global Footprint

India’s total exports have shown remarkable growth over the past decade, rising from US$ 468 billion in 2013–14 to US$ 825 billion in 2024–25, marking a substantial increase of approximately 76%.

This growth was supported by a marginal increase in merchandise exports, which stood at US$ 437.42 billion in FY 2024–25 compared to US$ 437.07 billion in the previous year, reflecting stability in goods-based trade. Over the decade, merchandise exports rose from US$ 310 billion in 2013–14 to US$ 437.42 billion in 2024–25, marking a 39% increase, driven by sectors such as engineering goods, petroleum products, and electronics.

Services exports more than doubled, expanding from US$ 158 billion in 2013–14 to US$ 387 billion in 2024–25, registering a remarkable growth.

India’s export surge in FY 2024–25 has been propelled by its top three export sectors — engineering goods, electronic goods, and drugs & pharmaceuticals — which have played a pivotal role in strengthening the country’s trade performance.

Global Capital Flows into India

India has rapidly become one of the world’s most attractive destinations for Foreign Direct Investment (FDI), fuelled by a decade of structural reforms, investor-friendly policies, and enhanced global competitiveness. Strengthened by improvements in key international rankings and strategic initiatives, investor confidence has surged.

The Government now aims to raise annual FDI inflows to US$ 100 billion, up from the current five-year average of over US$ 70 billion, aligning with efforts to position India as a global investment hub amid shifting supply chains.

These factors have boosted FDI investments in India with cumulative inflows reaching an impressive ₹89.85 lakh crore (US$ 1.05 trillion) between April 2000 and December 2024, marking nearly a 20-fold increase since FY01. India’s FDI equity inflows for April-December 2024 surged by 27% to ₹3.40 lakh crore (US$ 40.67 billion), reflecting robust investor confidence. This growth has been driven by reforms such as the liberalisation of FDI norms in key sectors, introduction of GST, and initiatives like Make in India.

Key achievements in FDI

• Highest ever annual FDI Inflow of USD 84.84 billion in the financial year 2021-22.

• FDI inflow USD 667.74 billion in the last 10 financial years (2014-24). It is nearly 67% of the total FDI reported in the last 24 years (USD 991.32 billion).

• Gross FDI inflows touched USD 1 trillion by September 2024.

• 26% Jump in FDI, in H1-FY 2024-25 FDI hits USD42+ Billion

• More than 90% of FDI Equity Inflow received under Automatic Route.

Production Linked Incentive Scheme

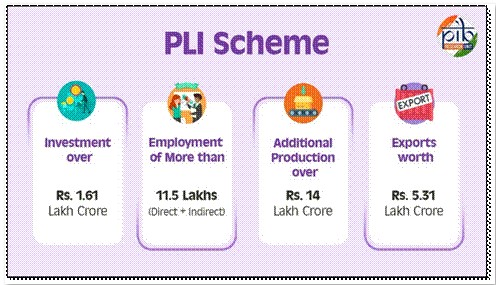

With an impressive outlay of ₹1.97 lakh crore (over US$26 billion), the PLI Schemes focus on 14 critical sectors, each strategically chosen to enhance the country’s manufacturing prowess, foster technological advancements, and elevate India’s position in global markets.

These sectors are aligned with the government’s goal of strengthening domestic production and expanding exports, contributing to the broader vision of Atmanirbhar Bharat.

The impact of PLI Schemes has been significant across various sectors in India. These schemes have incentivized domestic manufacturing, leading to increased production, job creation, and a boost in exports. They have also attracted significant investments from both domestic and foreign players.

PLI Schemes have transformed India’s exports basket from traditional commodities to high value-added products such as electronics & telecommunication goods, processed food products etc. PLI Schemes have witnessed exports surpassing ₹ 5.31 lakh crore (around US$ 61.76 billion), with significant contributions from sectors such as Large-Scale Electronics Manufacturing, Pharmaceuticals, Food Processing, and Telecom & Networking products.

Strengthening the MSME Sector

With over 6.3 crore enterprises, the MSME sector plays a vital role in employment generation and entrepreneurship, second only to agriculture. The government has supported the sector through initiatives focusing on credit access, technology, infrastructure, skill development, and market support, including for Khadi, Village, and Coir industries.

Digital Transformation in Payments

India has experienced a remarkable surge in digital payments, marking a pivotal shift towards a cashless economy. This growth has been enabled by government initiatives, collaborative stakeholder efforts, and robust digital infrastructure. At the centre of this transformation is Unified Payments Interface (UPI), alongside Immediate Payment Service (IMPS) and NETC FASTag, which have made transactions faster, safer, and more accessible.

India’s digital payment transactions have expanded at an exponential rate, reflecting increased digital adoption among individuals and businesses.

• Digital payment transactions grew from 2,071 crore in FY 2017–18 to 18,737 crores in FY 2023–24, achieving a Compound Annual Growth Rate (CAGR) of 44%.

• Over the same period, the value of transactions rose from ₹1,962 lakh crore to ₹3,659 lakh crore, with a CAGR of 11%.

UPI: The Flagship of India’s Digital Economy

Unified Payments Interface (UPI) is a transformative digital payment system that integrates multiple bank accounts into one mobile application, offering seamless fund transfers, bill payments, and merchant transactions. It has not only made financial transactions fast, secure, and effortless, but also empowered individuals, small businesses, and merchants, driving the country’s shift toward a cashless economy.

Internationalization of Digital Payments

India’s indigenously developed UPI and RuPay cards are world class platforms for enabling digital payments. Government is making efforts to promote these products globally.

At present UPI is fully functional and live in UAE, Nepal, Bhutan, Singapore, Mauritius, France and Sri Lanka. RuPay cards acceptance is live in UAE, Nepal, Bhutan, Singapore and Mauritius.

Building Blocks of Inclusive Growth: A 11 Years of Financial Empowerment in India

Over the past eleven years, India has made remarkable progress in deepening financial inclusion and promoting grassroots entrepreneurship. A suite of flagship schemes launched since 2014 has significantly broadened access to banking, insurance, pensions, and credit. Together, they have laid the groundwork for a more resilient, inclusive, and opportunity-driven economy.

1. Pradhan Mantri Jan Dhan Yojana (PMJDY)

• The number of PMJDY accounts increased from 14.72 crore in 2015 to 55.17 crore by April 2025.

• Total deposits in these accounts rose from ₹15,670 crore to ₹2.61 lakh crore, reflecting enhanced financial participation.

• Over 30.80 crore accounts are held by women, promoting gender-inclusive financial empowerment.

• Approximately 36.73 crore accounts are located in rural and semi-urban areas, ensuring outreach to underserved regions.

Launched in August 2014 by the Prime Minister Narendra Modi as a National Mission for Financial Inclusion (NMFI), PMJDY aimed to bring the vast unbanked population into the formal financial system, ensuring that every citizen has the opportunity to manage their financial activities effectively. The scheme, guided by the principles of “banking the unbanked, securing the unsecured, funding the unfunded, and serving the underserved,” has made significant strides in providing universal banking services to every unbanked household across the nation.

2. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

• As of March 2025, 23.36 crore individuals have enrolled in the scheme.

• Out of 9,37,524 claims received, 9,05,139 have been successfully disbursed, amounting to ₹18,102.78 crore.

Announced in the 2015 Union Budget in response to the fact that only 20% of Indians had insurance coverage, PMJJBY offers annual renewable life insurance. Over 9 lakh families have received timely support, making it one of the most impactful public life insurance schemes globally.

3. Pradhan Mantri Suraksha Bima Yojana (PMSBY)

• As of April 2025, the scheme has achieved 50.99 crore cumulative enrolments.

• Out of these, 23.82 crore women and 33.81 crore rural residents have benefitted, reflecting strong inclusivity.

• The scheme has received 2,09,112 claims, with 1,56,428 claims disbursed.

• Total claim payout stands at ₹3,106.58 crore.

Since its launch on 9th May 2015, the Pradhan Mantri Suraksha Bima Yojana (PMSBY) has made remarkable strides in expanding affordable accident insurance coverage across India.

With a nominal annual premium of ₹20 and easy bank-linked auto-debit enrolment, PMSBY has become a crucial instrument in providing financial protection to vulnerable sections, particularly in rural and low-income households.

4. Atal Pension Yojana (APY)

To tackle longevity risks and the lack of retirement security in the unorganised sector, APY was launched in 2015. It provides a defined monthly pension linked to contribution and age of entry. As of April 2025, the scheme has accumulated 7.65 crore subscribers and a total corpus of ₹45,974.67 crore. Women now constitute about 48% of all subscribers, a strong indicator of growing financial awareness and security among female workers.

5. Pradhan Mantri Mudra Yojana (PMMY)

More than 52.77 crore loan accounts have been extended with sanction amount of Rs. 34.11 lakh crore and disbursed amount of Rs. 33.33 lakh crore, since launch of the scheme.

Launched on 8 April 2015, Pradhan Mantri Mudra Yojana (PMMY), the Flagship Programme of the Prime Minister aimed at Funding the Unfunded micro enterprises and small businesses. By removing the burden of collateral and simplifying access, MUDRA laid the foundation for a new era of grassroots entrepreneurship. The scheme has ignited an entrepreneurial shift across India — from cities to villages, turning job seekers into job creators.

6. Stand-Up India Scheme

• Total accounts sanctioned (05.04.2016 to 31.03.2025): 2,73,607

• Total amount sanctioned: ₹62,410.04 crore

• Accounts sanctioned to SC/ST beneficiaries: 69,822

• Amount sanctioned to SC/ST beneficiaries: ₹14,705.64 crore

• Accounts sanctioned to women beneficiaries: 2,04,058

• Amount sanctioned to women beneficiaries: ₹47,704.44 crore

Since its inception on 5 April 2016, the Stand-Up India Scheme has enabled SC, ST, and women entrepreneurs to launch greenfield enterprises by facilitating bank loans. It has empowered thousands to start and grow businesses, creating livelihood opportunities and driving inclusive economic participation.

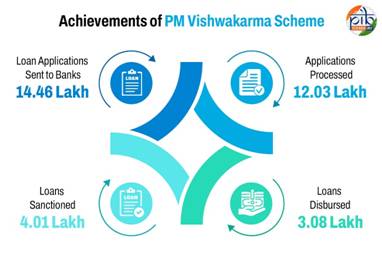

7. PM Vishwakarma: Empowering India’s Traditional Artisans

Launched on September 17, 2023, the PM Vishwakarma Scheme is a landmark initiative aimed at supporting traditional artisans and craftspeople across 18 identified trades such as blacksmiths, carpenters, potters, tailors, barbers, cobblers, and others. The scheme provides holistic support, including skill training, collateral-free credit, modern toolkits, market access, and incentives for digital transactions — helping integrate these artisans into the formal economy.

8. PM SVANidhi Scheme: Empowering Street Vendors with Affordable Credit

• No. of Accounts Sanctioned: 9,836,781

• Amount Sanctioned: Rs. 14,259 crores

• No. of Accounts Disbursed: 9,604,650

• Amount Disbursed: Rs. 13,782 crore

The PM SVANidhi Scheme, launched by the Ministry of Housing and Urban Affairs on June 1, 2020, aims to empower street vendors by providing hassle-free access to affordable credit and promoting their digital onboarding for economic development. The scheme offers collateral-free working capital loans up to Rs. 50,000 in three tranches, along with a 7% per annum interest subsidy and cashback incentives of Rs. 1 per digital transaction (up to Rs. 1,200 annually). Initially valid until December 31, 2024, the scheme is currently under extension.

From High Prices to Stability: A Decade of Inflation Control

Over the last two decades, India has seen a remarkable transformation in its inflation landscape. Between 2004–05 and 2013–14, inflation averaged 8.2%, with several years experiencing double-digit rises, largely driven by surging food and fuel prices. This period put pressure on household budgets and created uncertainty for businesses.

However, from 2015–16 to 2024–25, inflation has moderated significantly to an average of around 5%. This shift reflects strong policy interventions, including inflation-targeting by the Reserve Bank of India, improved supply chain management, and sound fiscal discipline by the Government. As a result, price stability has improved, boosting consumer confidence and supporting sustainable economic growth.

Conclusion

Over the past decade, India has undergone a profound economic transformation rooted in structural reforms, visionary policymaking, and unwavering political will. From achieving historic GDP growth and record exports to revolutionising digital payments and empowering millions through financial inclusion, the country has laid the foundation for a resilient, equitable, and future-ready economy. With robust FDI inflows, expanding trade, and innovation-driven sectors leading the charge, India is no longer a passive participant in the global economy, it is a key architect of its future. As the country moves confidently toward its goal of becoming a top three economic power, the momentum of the last eleven years signals that India’s economic rise is not just a moment — it is a movement.