Securing Retirement for Poor

Atal Pension Yojana (APY) is proving to be a great help for people in India’s Unorganised Sector towards “Pension for All”

In tune with its philosophy of “Sab ke Saath”, the Modi government at the centre is addressing the twin challenges of longevity risks and lack of retirement security among India’s vast unorganised workforce.

The Government of India launched the Atal Pension Yojana (APY) on 9th May 2015 that was operationalized from 1st June 2015.

The scheme was designed to encourage voluntary savings for retirement by offering defined pension benefits, linked to the age of joining and amount of contribution.

Targeted primarily at poor and underprivileged workers in the informal sector, the scheme has emerged as one of the most inclusive and accessible social security initiatives in India.

A Government release reveals the following:

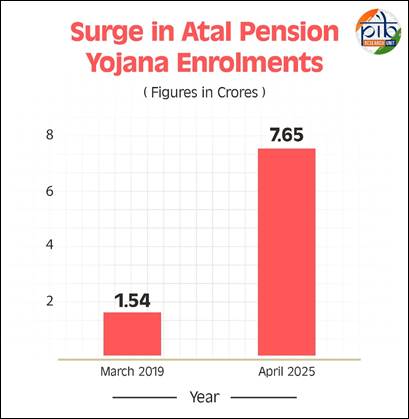

As of April 2025, APY has accumulated over 7.65 crore subscribers, mobilised a total corpus of ₹45,974.67 crore, and recorded increasing participation from women, who now comprise about 48% of all subscribers.

Salient Features of Atal Pension Yojana (APY)

The APY is characterized by the following key features:

1. Target Group

• Aimed at workers in the unorganised sector, who often lack formal pension coverage.

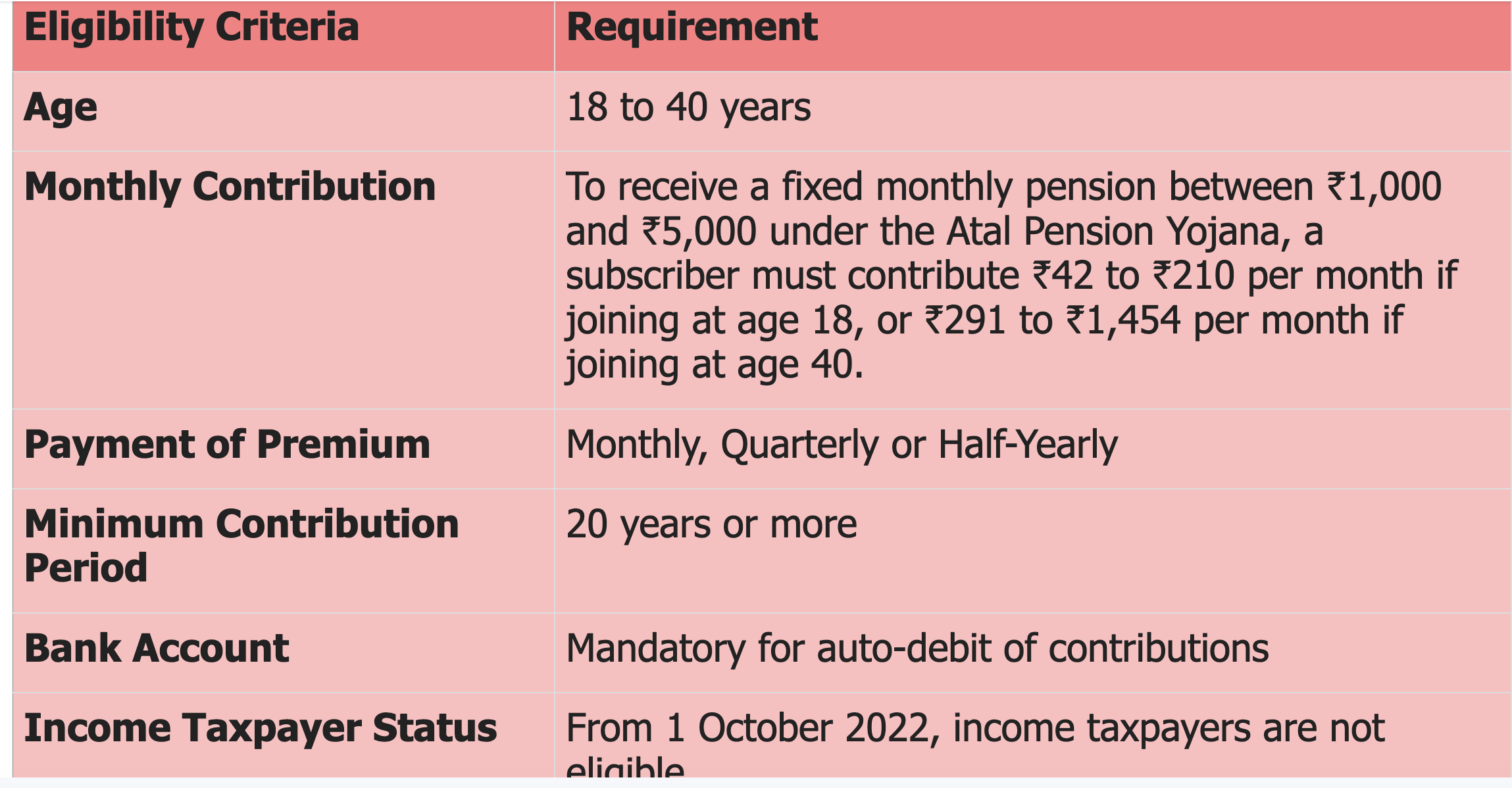

• Initially available to all citizens of India between 18 and 40 years of age.

• With effect from 1st October 2022, individuals paying income tax are not eligible to join the scheme.

2. Defined Pension Benefit

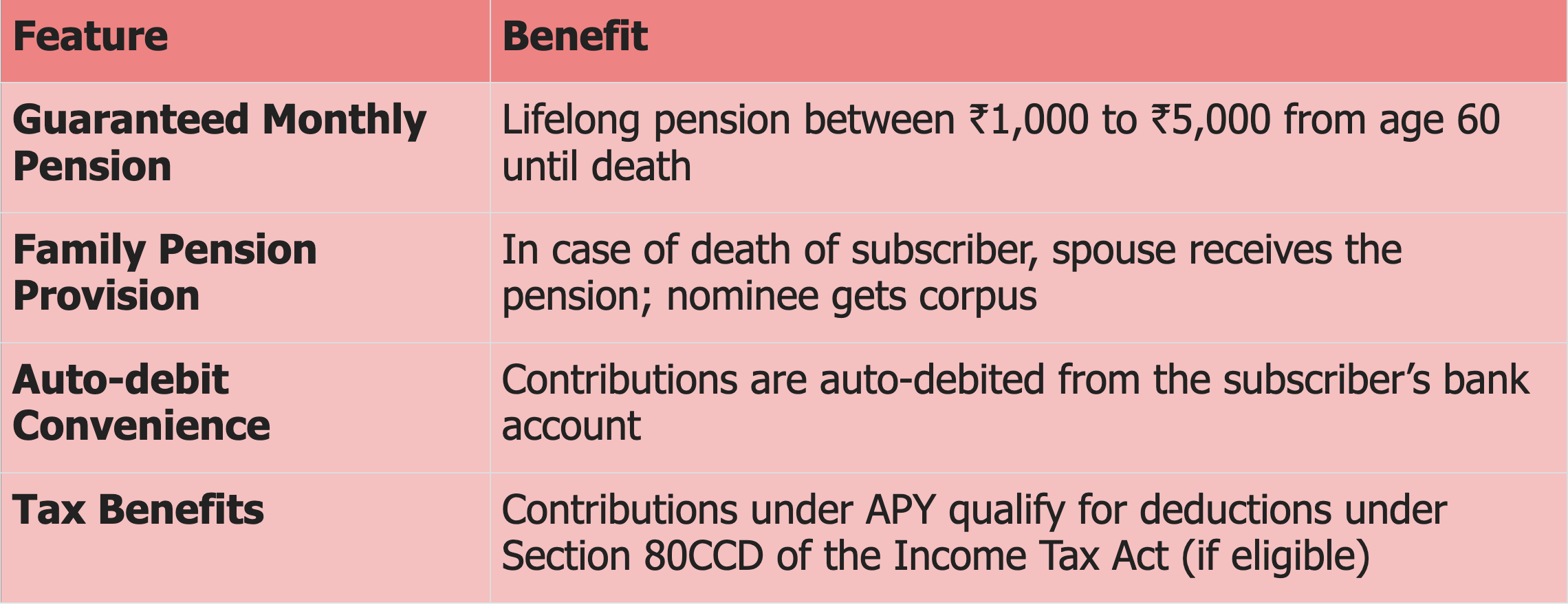

• Provides subscribers with a fixed monthly pension at the age of 60 years, based on their contributions.

• Pension slabs available: ₹1,000, ₹2,000, ₹3,000, ₹4,000, and ₹5,000 per month.

3. Contribution Period and Calculation

• Minimum contribution period is 20 years, depending on age of joining.

• Monthly contribution varies based on:

– Age at the time of enrolment

– Desired pension amount

4. Government Co-contribution (for Early Joiners)

• For eligible subscribers who joined between 1 June 2015 and 31 March 2016 (The scheme is continued but without Government Co-contribution).

• The government co-contributed 50% of the total contribution or ₹1,000 per annum (whichever is lower) for 5 years.

• This applied only to subscribers not covered under any statutory social security scheme and not income taxpayers at the time.

5. Administering Body

• Administered by Pension Fund Regulatory and Development Authority (PFRDA).

• Managed under the National Pension System (NPS) architecture.

Benefits to Subscribers

Exit and Withdrawal Options

• Exit at age 60: Full pension begins.

• Exit before age 60: Permitted only in cases of death or terminal illness.

• Voluntary Exit: Allowed, but the subscriber only receives the contribution made (with interest) and government co-contribution (if any) is forfeited.

Joint Awareness Efforts by the Government and PFRDA

• The Pension Fund and Regulatory Development Authority (PFRDA) over the past few years has taken several initiatives for awareness creation of the scheme, such as:

– Conducting APY Outreach Programmes at State and District levels

– Organising awareness and training programmes

– Publicity through various media channels

– Regular performance review

• Activating online channels such as e-APY, net-banking, mobile app and bank’s web-portal, for easy online onboarding.

• APY Help Desk and Chatbot at Protean – CRA are operational for assisting APY subscribers.

• QR Codes for APY User services, APY Transactional services, APY Information services, APY Podcast/Videos, APY Call Centre are available for creating awareness regarding the benefits of APY and services that are being offered to APY subscribers.

Conclusion

The Atal Pension Yojana has emerged as a cornerstone of India’s social security ecosystem, especially for its vast unorganised workforce. With nearly 7.65 crore subscribers and a steadily growing pension corpus, the scheme not only ensures financial independence for the elderly but also promotes long-term savings culture among low-income households. The government’s continued focus on digital integration, women participation, and rural outreach has helped broaden APY’s footprint across India. With women making up over 55% of new subscribers in FY 2024–25 and a significant surge in overall enrolments during the same period, the Atal Pension Yojana is steadily progressing toward its vision of “Pension for All.”